OFF POS

Popular Search:

- Forums,

- Getting Started,

- Community

Popular Search:

How does Tax calculated in selling time on a product?

Earlier we mentioned in the "Tax Item Profile" article how tax applies to a product.

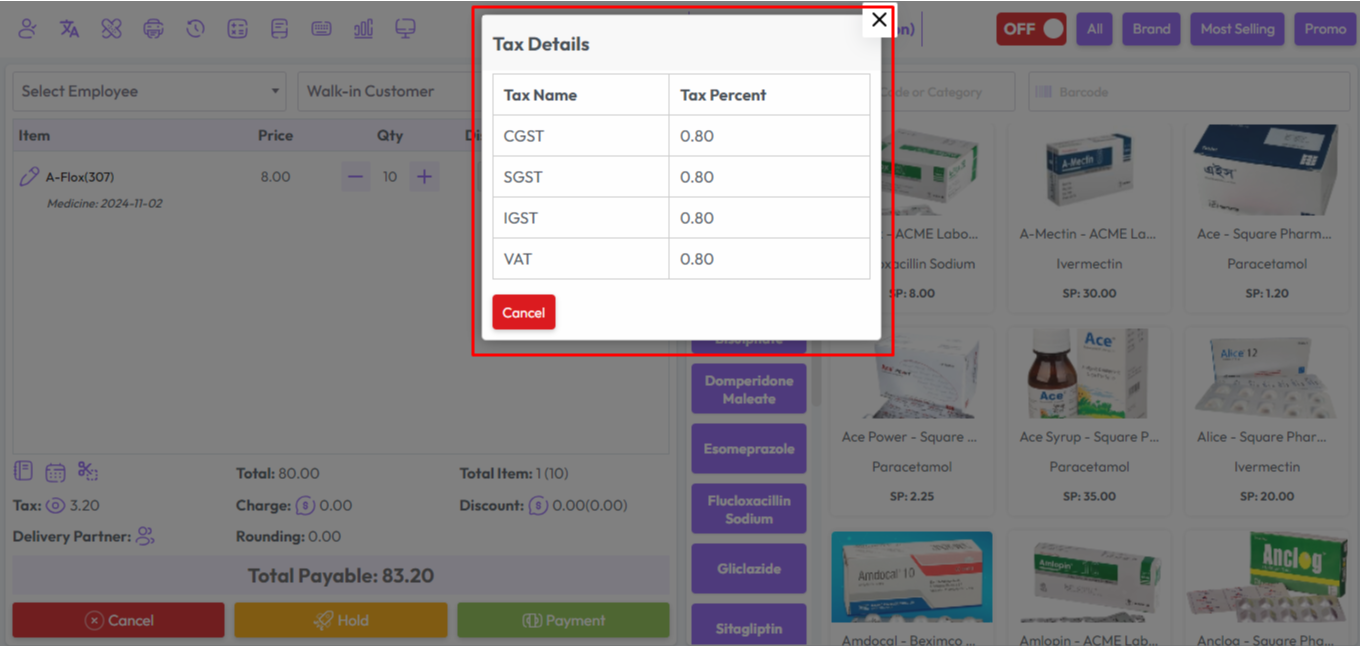

We know that there is an option to pay tax on the product while adding the product, Those taxes will be effective at the time of sale according to the amount of tax given in the product profile.

Let's make an example:

Step 1: Let's assume a product's price is 103, and the applied tax is CGST = 1%, SGST = 1 %, IGST = 1% and VAT = 1% respectively

So, Tha tax calculation formula will be ((Total Tax percentage * Product Price) / 100), According to this formula the amount will be for CGST, SGST, IGST = ((4 * 80) / 100) = 3.20

NB: Note that this formula only applicable for when customer is Different state, If customer is same sate Tax Calculation formula will be same but tax will be applied only "CGST, SGST, VAT"

Was this page helpful?

Thank you for your feedback!

Please Login First

Sign in to post your comment or signup if you dont have any account.

Need help? Search our help center for answers or start a conversation:

In publishing and graphic design, Lorem ipsum is a placeholder text commonly used to demonstrate the visual form of a document or a typeface without relying on meaningful content. Lorem ipsum may be used as a placeholder before final copy is available.

0 Comments