OFF POS

Popular Search:

- Forums,

- Getting Started,

- Community

Popular Search:

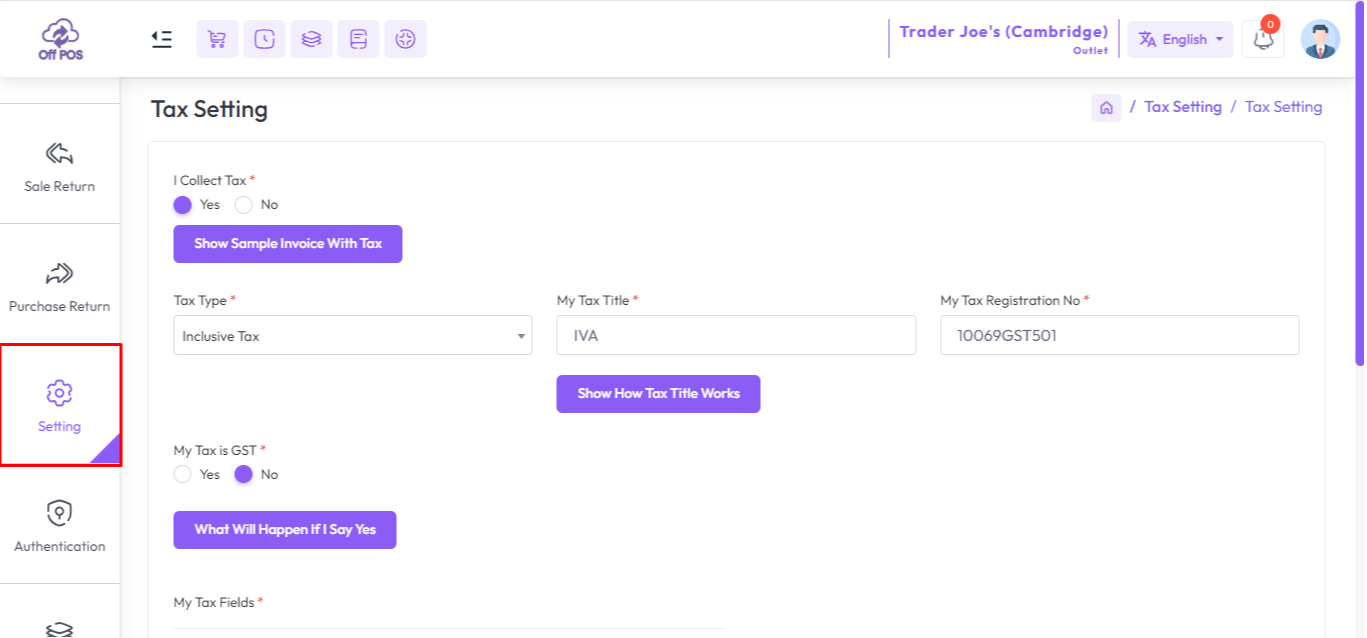

To Set your tax for your business Click the Setting menu from the left sidebar and click on Tax Menu.

Here this is your Business tax setting, Read the tax document sequentially

I Collect Tax: No

I collect tax no means you're not applied any tax over the product.

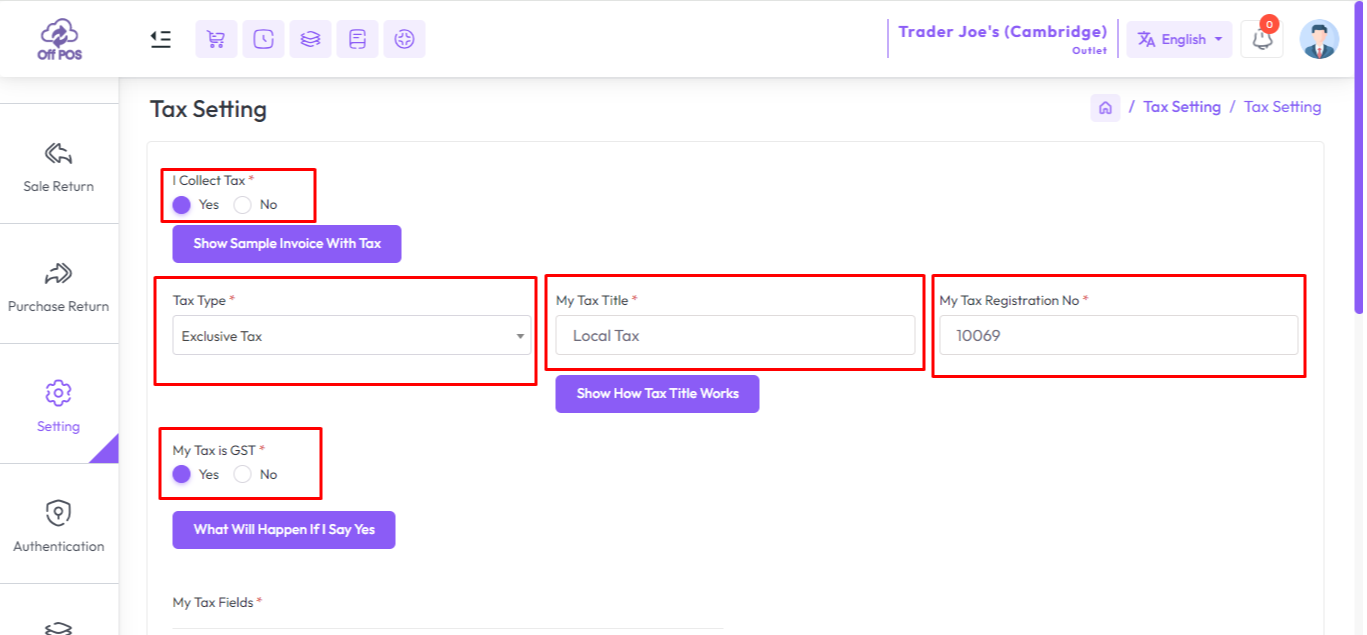

I Collect Tax: Yes

I collect tax yes means you're trying to apply tax over the product.

Let's try to understand more deeply!

Here we can see "Tax Type" has two options, One is Exclusive Tax, Inclusive Tax.

Inclusive Tax: Inclusive tax means that the tax amount is included in the displayed price of the product or service. The customer pays the total amount displayed, which includes both the base price and the tax. In this case, the tax is not listed separately on the receipt because it's already included in the total price.

Exclusive Tax: Exclusive tax, on the other hand, means that the tax amount is not included in the displayed price of the product or service. Instead, the tax is added to the base price at the time of purchase, and the customer pays the total amount, which includes both the base price and the separately listed tax amount. The tax is listed on the receipt to show how much was charged for the product or service and how much was charged for taxes.

Tax Title & Tax Registration No: Tax Title and Tax Registration No will be shown in invoice for example: Local Tax: 10069

My Tax Is GST: Yes

If you dont enter customer's GST number, system will apply CGST and SGST But for this you have to add CGST, SGST, IGST and VAT in Tax Fields In POS, when selecting customer you will get option to set customer's GST Number and system will match your state code with customer's state code, if these match, system will apply CGST and IGST, if does not, system will apply CGST and SGST

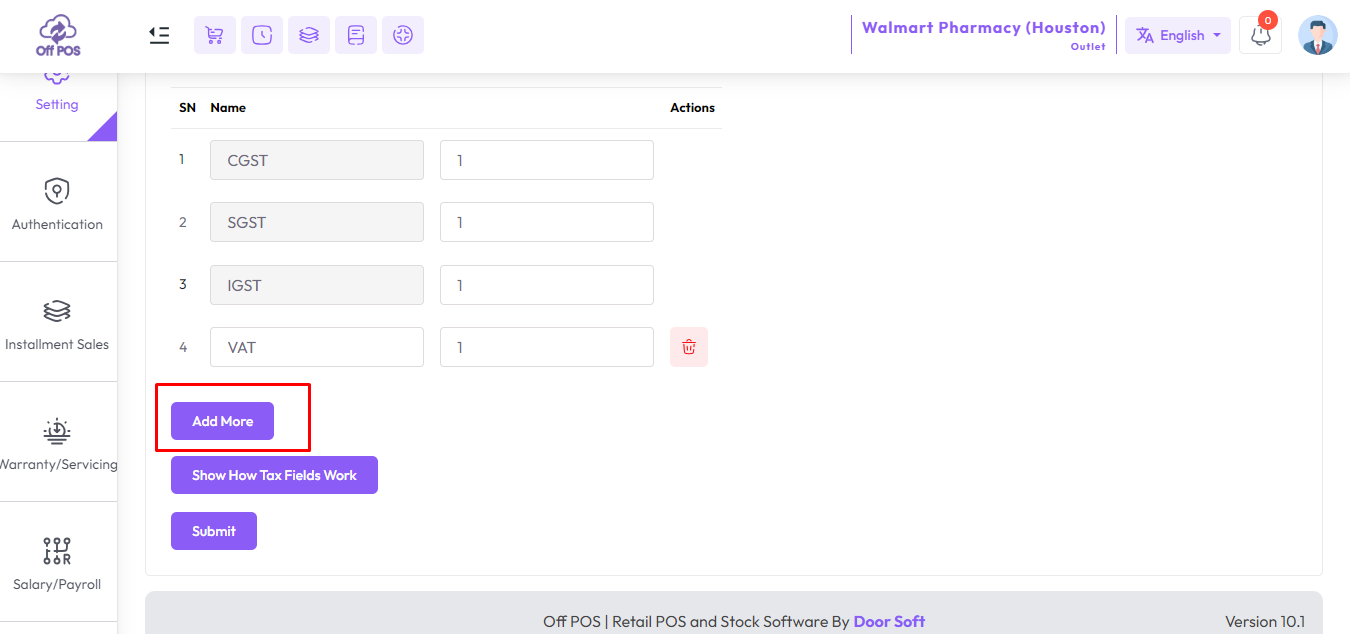

My Tax Fields: How it works?

All of these input fields will be appeared in each of your Item profile. You can then set amount application for all of these for that specific item. If an item does not have any of these's tax, you just put that\'s value 0. Like if you use GST and the item is an alchohol item you will set value in only VAT field and leave other field blank, then only VAT will be applicable for that item. If you are using GST, you should put value in all CGST, SGST and IGST, system will determine where to select SGST or IGST as you have chosen My Tax is GST above. And if you are dealing with a single Tax amount, just add one field here. Note that which names you add here, will be appeared in your invoice.

Click "Add More" button if you need extra Tax or any custome and hit the submit button to save this.

Was this page helpful?

Thank you for your feedback!

Please Login First

Sign in to post your comment or signup if you dont have any account.

Need help? Search our help center for answers or start a conversation:

In publishing and graphic design, Lorem ipsum is a placeholder text commonly used to demonstrate the visual form of a document or a typeface without relying on meaningful content. Lorem ipsum may be used as a placeholder before final copy is available.

0 Comments